The income tax rate for Trusts is moving to 39% (from 33%) from 1st of April 2024, a significant increase for trusts.

What if my Trust owns my Company?

If you have a company with shares owned by your Trust we are encouraging you to review your position and carry out an analysis of whether a dividend should be declared to the Trust this year before the tax rate changes.

Why should you be thinking about this?

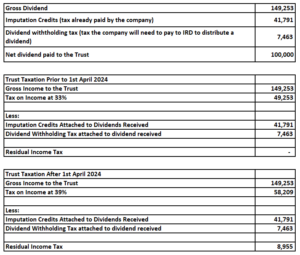

In basic terms, if you don’t, then when you need to distribute money out of the company to your Trust, the Trust will have to pay a 39% tax on it which will be an additional 6% of tax if this is done after 1st April 2024. As an example, let’s say your company needs to pass on $100,000 of retained earnings to your Trust. To do this, your company will need to pay a dividend as calculated below. As you can see, if this is done after 1st of April 2024, there will be an additional $8,955 of tax to pay to IRD on this when compared with doing this prior to 1st April 2024.

But I don’t need to take any money out of my company so it doesn’t affect me right?

This may be true at this point in time. However looking longer term, let’s say you sell your business or wind it up. To close down your company you need to distribute your retained earnings to the shareholders which means doing a dividend. At this point, you will need to do the above and if you haven’t taken advantage of the 33% tax rate when it was available, any retained earnings prior to 1st April 2024 will incur the 39% tax rate when it could have been taxed at 33%.

How Can We Help?

We can carry out a review of your company and Trust to identify whether we recommend declaring a dividend. Get in touch with us to discuss.

reception@mccd.co.nz